Borrowers seeking car title loans in Nacogdoches, TX, must prioritize understanding loan agreements. Key aspects include thorough vehicle inspections and varying loan terms. Examining these carefully allows for informed decisions, rate comparisons, and avoiding common pitfalls like high-pressure sales and unfavorable conditions. Focus on legitimate use cases like emergency funds or industry-specific needs, and always negotiate terms for clear understanding, transparent processes, flexible plans, and swift approval with minimal documentation.

In the market for a quick cash solution in Nacogdoches, TX? Car title loans could be an option, but understanding the terms and conditions is crucial. This guide navigates the process, highlighting common pitfalls to avoid. From ‘red flag’ clauses to negotiating your agreement, you’ll learn how to protect yourself and make informed decisions about car title loans in Nacogdoches, ensuring a smooth borrowing experience.

- Understanding Car Title Loan Agreements: Key Terms and Conditions in Nacogdoches TX

- Common Pitfalls to Avoid When Securing a Car Title Loan in Nacogdoches TX

- Protecting Yourself: Tips for Reviewing and Negotiating Your Car Title Loan Agreement

Understanding Car Title Loan Agreements: Key Terms and Conditions in Nacogdoches TX

In the world of car title loans Nacogdoches TX, understanding the agreement is paramount to avoiding potential pitfalls. Car title loan agreements can be complex, but knowing key terms and conditions is essential for borrowers in Nacogdoches. One crucial aspect is the vehicle inspection process, where lenders assess the condition and value of your vehicle, which serves as collateral for the loan. This step ensures both parties are on the same page regarding the asset’s worth.

Additionally, loan terms, including repayment periods and interest rates, vary among lenders. Borrowers should carefully review these to determine their financial commitment. Interest rates in particular can significantly impact the overall cost of the loan, so comparing rates from different lenders in Nacogdoches TX is wise. Being informed about these conditions empowers borrowers to make informed decisions, ensuring a smoother borrowing experience with car title loans.

Common Pitfalls to Avoid When Securing a Car Title Loan in Nacogdoches TX

When considering a car title loan in Nacogdoches TX, it’s crucial to stay vigilant and avoid common pitfalls that can lead to financial strain. One major trap is failing to understand the repayment options offered by lenders. Car title loans often come with high-pressure sales tactics, pushing borrowers into accepting unfavorable terms and interest rates. Before signing any agreements, thoroughly review the loan details, including the repayment schedule, to ensure it aligns with your financial capabilities.

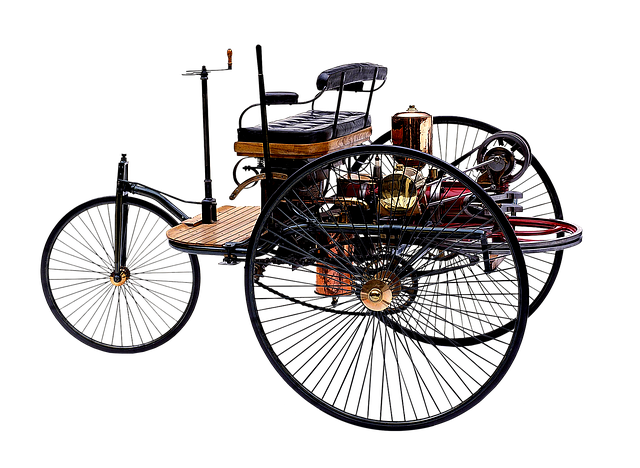

Another mistake to steer clear of is using a car title loan for non-essential purposes like luxury items or debt consolidation without a solid plan for repayment. While these loans can be useful for unexpected expenses, treating them as a quick fix for long-term debt (like credit cards or personal loans) is risky. Prioritize understanding the loan’s purpose—be it for emergency funds, home repairs, or even semi-truck loans if you’re in the transportation industry—and explore options like debt consolidation only when combined with a realistic repayment strategy to avoid further financial complications.

Protecting Yourself: Tips for Reviewing and Negotiating Your Car Title Loan Agreement

When considering a car title loan in Nacogdoches TX, protecting yourself starts with a thorough review and negotiation of your agreement. Always ensure that all terms and conditions are clearly understood before signing. Car title loans can be complex, so pay close attention to interest rates, repayment periods, and any additional fees. Check for hidden costs or penalties for early repayment, as these could significantly impact the overall cost of your loan.

During negotiation, don’t be afraid to ask questions or seek clarification on points you’re unsure about. Understand the process for making payments, including whether they are due monthly or weekly, and how late fees are calculated. A transparent and fair loan agreement is crucial, so look for a lender that offers flexible payment plans and performs a thorough credit check without penalizing you. Ensure your loan approval process is swift and straightforward, with minimal documentation requirements, to avoid any unnecessary delays in accessing the funds you need.

When considering car title loans Nacogdoches TX, it’s vital to be informed about potential pitfalls. By understanding key terms and conditions, reviewing agreements carefully, and negotiating where possible, you can protect yourself from unfair practices and ensure a loan that aligns with your financial needs. Stay vigilant, know your rights, and make an informed decision for your car title loan in Nacogdoches TX.