Car title loans in Nacogdoches, TX, provide quick cash for individuals with poor credit, using their vehicle's title as collateral. While offering flexibility and lower requirements than traditional bank loans, these loans come with significant risks, including high-interest rates, potential repossession upon default, and hidden fees. Thorough research is crucial to ensure a secure and beneficial loan agreement.

Car title loans Nacogdoches TX have gained popularity as a quick cash solution for residents facing financial emergencies. This article explores both sides of this alternative lending option. We begin with a concise overview, explaining what car title loans are and how they work. Subsequently, we delve into the advantages, such as faster approvals and higher loan amounts compared to traditional methods. However, we also highlight the potential drawbacks and risks, including high-interest rates and the risk of losing one’s vehicle if unable to repay.

- Understanding Car Title Loans: A Quick Overview

- Advantages of Car Title Loans in Nacogdoches, TX

- Disadvantages and Potential Risks to Consider

Understanding Car Title Loans: A Quick Overview

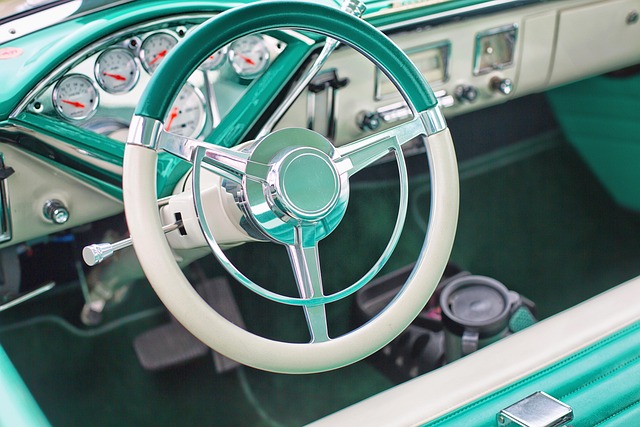

Car title loans Nacogdoches TX are a type of secured lending where individuals use their vehicle’s title as collateral to borrow money. This alternative financing option is designed for borrowers who need quick access to cash, especially when traditional loan applications might be denied due to poor credit or lack of financial history. The process involves using the car’s registration and title as security, allowing lenders to repossess the vehicle if the borrower defaults on repayments.

This type of loan offers a straightforward and fast way to secure funds. Lenders typically evaluate the vehicle’s value and offer a loan amount based on its equity. While it can be an attractive financial solution for those in need, it also carries risks. Borrowers must understand that failure to repay can result in permanent loss of their vehicle. Moreover, interest rates and fees associated with car title loans Nacogdoches TX can vary widely, so thorough research and comparison are essential before making a decision.

Advantages of Car Title Loans in Nacogdoches, TX

In Nacogdoches, TX, car title loans offer a unique financial solution for those in need of quick cash. One of the primary advantages is their accessibility; compared to traditional bank loans, these loans have less stringent requirements. Individuals with poor credit or no credit history can still apply and potentially secure funding, making them an attractive option for many. The process is straightforward, often involving just a few simple steps to borrow against the equity of one’s vehicle.

Additionally, car title loans provide a flexible payment structure. Lenders typically offer extended repayment periods, allowing borrowers to pay back the loan in manageable installments over time. This flexibility can be a significant advantage for borrowers who anticipate fluctuations in their income or prefer a less burdensome repayment experience compared to other loan types like Fort Worth Loans. Unlike a Title Pawn, which may require immediate repayment, these loans provide breathing room, making them suitable for unexpected expenses or short-term financial needs without the pressure of quick liquidation.

Disadvantages and Potential Risks to Consider

While car title loans Nacogdoches TX can provide a quick financial solution, it’s essential to consider several potential disadvantages and risks. One significant drawback is the high-interest rates associated with these loans, often much higher than traditional bank loans. This can lead to a cycle of debt where borrowers struggle to repay both the principal and accumulating interest. Additionally, if you default on your loan, lenders have the right to repossess your vehicle, leaving you without transportation.

Another risk is the potential for hidden fees. Lenders may charge various fees, such as administration or processing fees, which can add substantial costs to your overall debt. The quick approval process, often advertised as a benefit of car title loans, doesn’t account for the possibility of being trapped in a predatory lending practice. Before taking out such a loan, thoroughly research lenders and understand all terms and conditions to avoid these pitfalls.

Car title loans Nacogdoches TX can provide a quick solution for emergency funding, but it’s crucial to weigh both the advantages and disadvantages before applying. While they offer benefits like accessible credit and flexible repayment terms, there are significant risks associated with high-interest rates and potential vehicle repossession if payments are missed. Thoroughly understanding these dynamics is essential to make an informed decision regarding car title loans in Nacogdoches, TX.