Car title loans Nacogdoches TX offer swift, accessible funding for residents with poor credit or lacking traditional qualifications, utilizing vehicles as collateral. The process involves three steps: applying, vehicle valuation, and a soft credit check. Ideal for emergencies or personal goals, these loans empower individuals to leverage their assets with fast turnaround times and minimal hassle. Borrowers can use funds for various purposes like home improvements, business expansion, debt consolidation, tuition, or medical bills. Responsible borrowing is key; timely payments and refinancing options help manage debt while preserving vehicle ownership.

In the vibrant city of Nacogdoches, TX, car title loans offer a smart financial solution for residents seeking quick cash. This article explores the potential of these loans, providing insights into how borrowed funds can be creatively utilized. From home improvements to unexpected expenses, car title loans in Nacogdoches TX offer flexible opportunities. We’ll guide you through responsible borrowing strategies, ensuring a positive financial experience while highlighting unique ways to maximize your loan proceeds for various needs.

- Understanding Car Title Loans Nacogdoches TX: Unlocking Financial Opportunities

- Creative Ways to Utilize Funds from Car Title Loans in Nacogdoches

- Responsible Borrowing and Repayment Strategies for Car Title Loans in Texas

Understanding Car Title Loans Nacogdoches TX: Unlocking Financial Opportunities

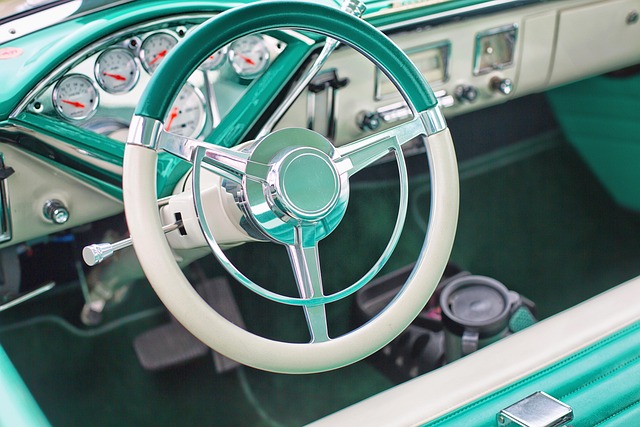

Car title loans Nacogdoches TX offer a unique opportunity for residents to access quick funding by using their vehicle as collateral. This alternative financing method is especially beneficial for those in need of immediate cash and who may not qualify for traditional bank loans due to poor credit or lack of collateral. The process involves a simple three-step procedure: applying, vehicle valuation, and a credit check. During the application phase, borrowers provide personal information and details about their vehicles. Following this, an expert will assess the market value of the car to determine its worth as collateral. Lastly, a soft credit check is conducted to evaluate the borrower’s financial health without impacting their credit score.

This type of loan can be a game-changer for many, providing a safety net during financial emergencies or offering a means to achieve personal goals. It empowers individuals to take control of their financial destiny by leveraging an asset they already own—their vehicle. Whether it’s for unexpected expenses, home improvements, or even starting a small business, car title loans Nacogdoches TX can unlock a world of financial opportunities with minimal hassle and fast turnaround times.

Creative Ways to Utilize Funds from Car Title Loans in Nacogdoches

In Nacogdoches, car title loans TX offer a unique opportunity for individuals to access quick funding with their vehicle’s equity as collateral. Beyond the traditional use for unexpected expenses or emergencies, there are creative ways to put these funds to smart and productive use. For instance, many people choose to invest in home improvements or renovations, turning their vehicles into a catalyst for enhancing their living spaces. Others may opt for starting or expanding small businesses, leveraging the loan proceeds to purchase inventory, equipment, or even hire initial staff members.

Additionally, car title loans can be a strategic move for those looking to consolidate high-interest debt or make significant purchases like college tuition or medical bills. By securing a loan with their vehicle, borrowers can often take advantage of lower interest rates compared to conventional personal loans. Even more, if managed responsibly, the borrowed funds can become an investment in one’s future financial stability. For example, using Fort Worth loans (a common type of car title loan) to fund professional development courses or training can lead to better career prospects and higher earning potential down the line.

Responsible Borrowing and Repayment Strategies for Car Title Loans in Texas

Responsible borrowing is key when considering a car title loan in Nacogdoches, TX. It’s important to understand that this type of loan uses your vehicle’s title as collateral, so it’s crucial to have a solid repayment strategy in place before taking out any funds. Lenders will typically offer loans based on the value of your vehicle and your ability to repay. Borrowing only what you need and creating a realistic budget for repayment can help avoid financial strain later.

The title loan process in Texas involves an online application where lenders assess your vehicle’s worth and your creditworthiness. After approval, funds are disbursed, typically ranging from a few hundred to several thousand dollars. To manage the debt effectively, make timely payments as agreed upon. If financial difficulties arise, exploring options like loan refinancing might be considered. Refinancing could potentially lower interest rates or extend the loan term, providing some relief while ensuring continued vehicle ownership.

Car title loans Nacogdoches TX can be a clever way to access immediate financial support. By understanding the process and employing responsible borrowing strategies, individuals in Nacogdoches can creatively utilize these funds for various needs, from unexpected expenses to business opportunities. It’s essential to remember that while car title loans can provide a solution, they should be considered carefully and repayable to avoid potential financial strain. With the right approach, these loans can empower residents of Nacogdoches TX to navigate their financial landscape effectively.